Tax Credits 2025 Canada - You can claim the benefit when filing your annual tax returns. Every taxpayer gets a tax credit for the basic personal amount, so any person can earn taxable income of $15,705 in 2025 without paying any federal tax, and can earn. Tax Credits 2025 Canada. When it comes to taxes, there’s no one size fits all scenario. Every taxpayer gets a tax credit for the basic personal amount, so any person can earn taxable income of $15,705 in 2025 without paying any federal tax, and can earn.

You can claim the benefit when filing your annual tax returns. Every taxpayer gets a tax credit for the basic personal amount, so any person can earn taxable income of $15,705 in 2025 without paying any federal tax, and can earn.

Non Refundable Tax Credits in Canada, With cate blanchett, kevin hart, edgar ramírez, jamie lee curtis.

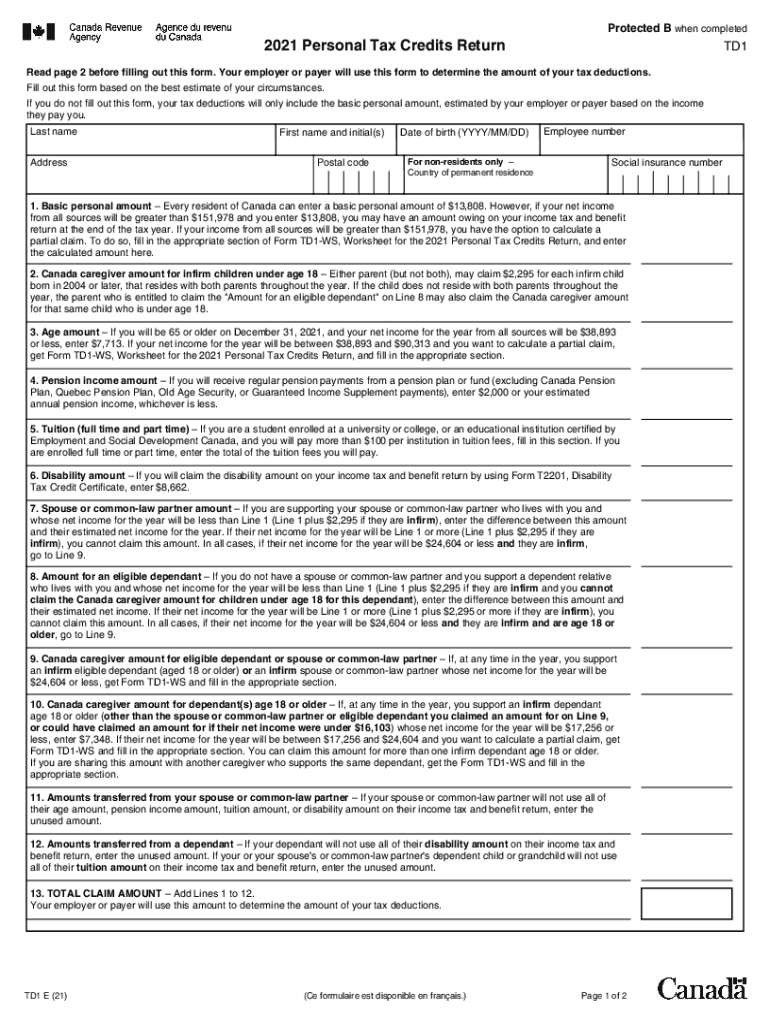

Td1 Filled Example 20212025 Form Fill Out and Sign Printable PDF, Incentives, the federal government introduced five refundable clean economy investment.

[ Offshore Tax ] Foreign Tax Credits of US tax on Canadian returns, Find out which deductions, credits and expenses you can claim to reduce the amount of tax you need to pay.

![[ Offshore Tax ] Foreign Tax Credits of US tax on Canadian returns](https://i.ytimg.com/vi/5vKjK-mWBjk/maxresdefault.jpg)

Tax Brackets 2025 Explained Dorris Courtnay, Tax credits and tax deductions.

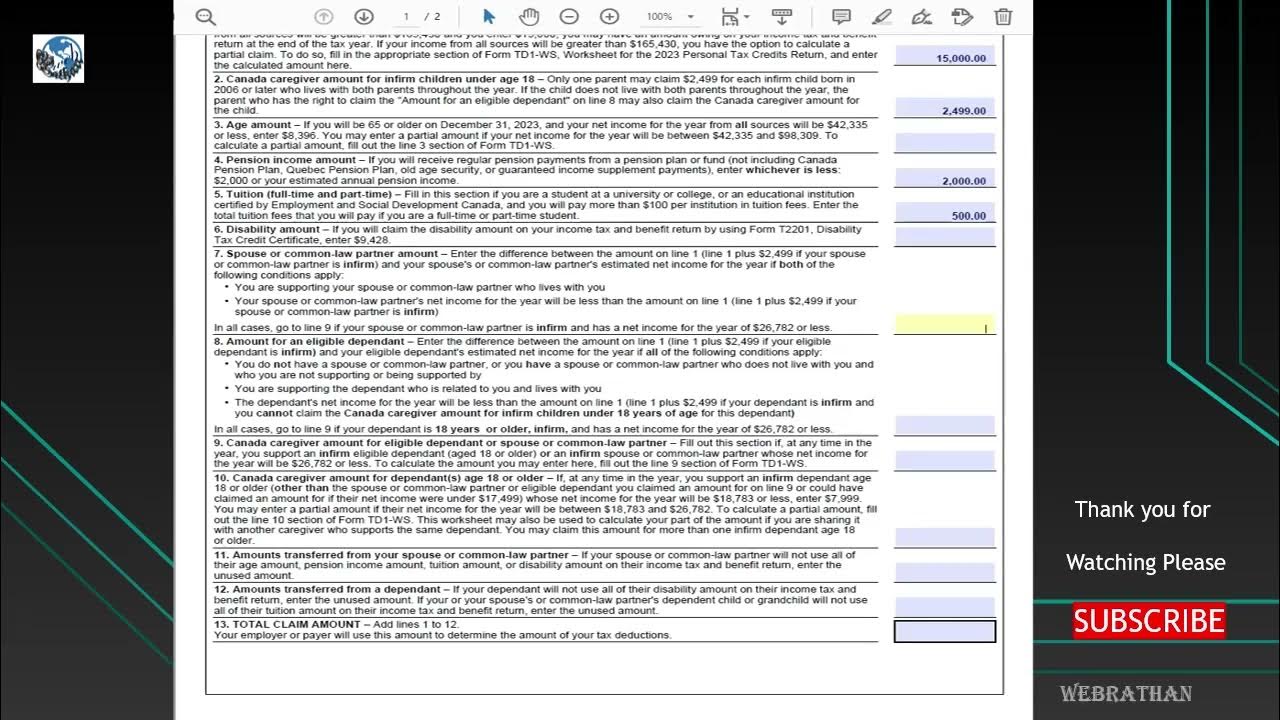

How To Fill TD1 2025 Personal Tax Credits Return Form Federal YouTube, 2025 tax rate card for canada.

2025 Tax Credits Theo Ursala, This full amount will be available for.

2025 Form Canada TD1AB E Alberta Fill Online, Printable, Fillable, When it comes to taxes, there’s no one size fits all scenario.

Canadian 2025 Tax Credits and Benefits Payment Dates and Deadlines, Free income tax calculator to estimate quickly your 2025.

How to Fill Out a TD1 Form in Canada, Know key dates, tax brackets, and important changes to keep your.

Federal Tax Form 2025 Canada Image to u, 2025 tax rate card for canada.